Table of Contents

ToggleBest Accounting Apps

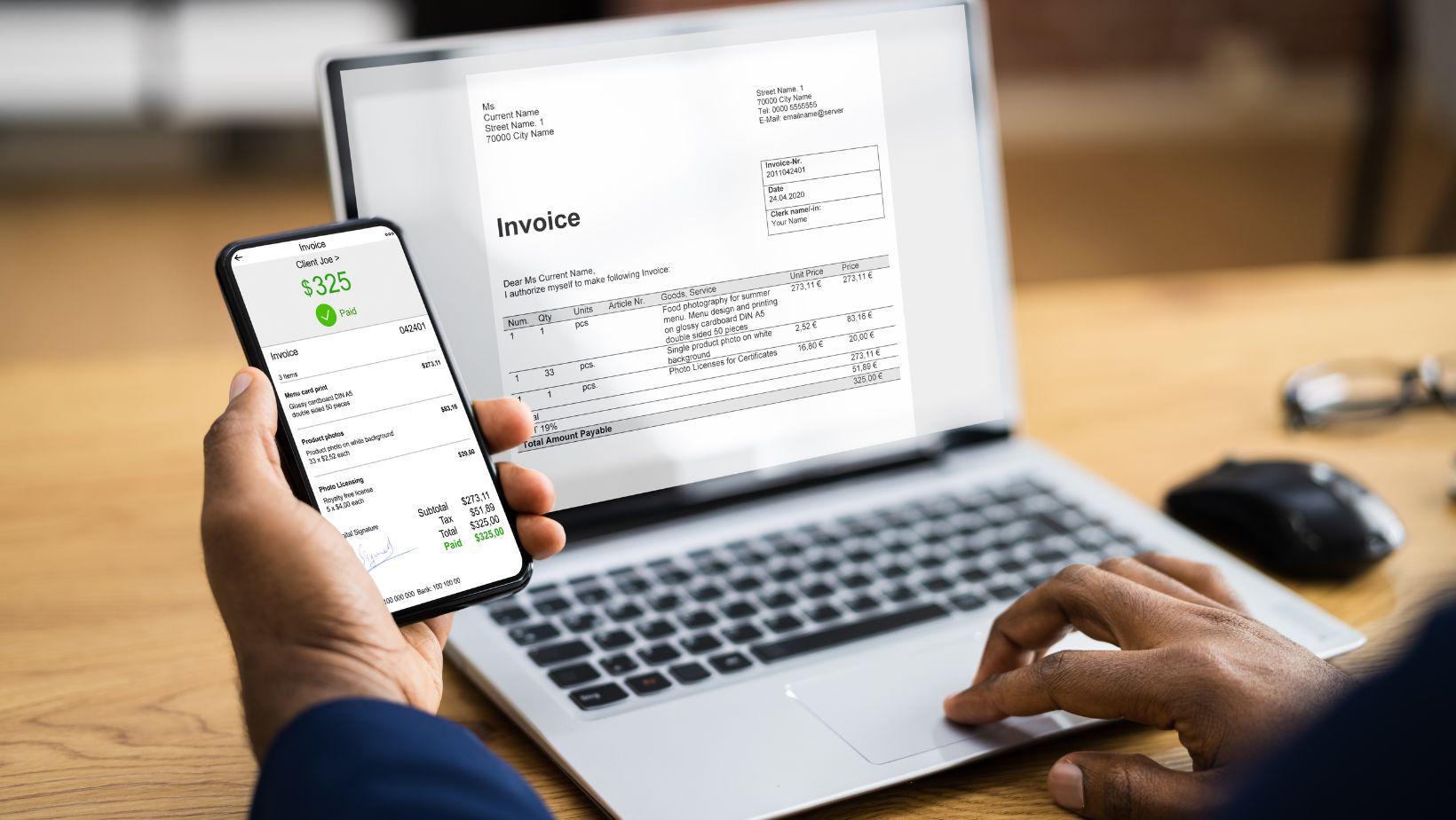

When evaluating the best accounting apps, users should prioritize essential features to meet their specific financial management needs effectively. Key features to consider include invoicing capabilities, expense tracking, bank reconciliation tools, customizable reporting functionalities, and multi-user access for collaboration.

Another crucial aspect to assess when selecting best accounting apps is their integrations and compatibility with other software systems. Users should ensure that the chosen app can seamlessly integrate with their existing tools such as CRM software, payment gateways, tax preparation software, and banking platforms. Compatibility across devices like desktop, mobile, and tablets is also essential for a seamless user experience.

Top Accounting Apps for Small Businesses

QuickBooks: A Comprehensive Tool

QuickBooks stands out as a comprehensive accounting tool, offering a wide range of features essential for small business financial management. With functionalities like invoicing, expense tracking, and financial reporting, QuickBooks provides a one-stop solution for businesses looking to streamline their accounting processes efficiently.

QuickBooks stands out as a comprehensive accounting tool, offering a wide range of features essential for small business financial management. With functionalities like invoicing, expense tracking, and financial reporting, QuickBooks provides a one-stop solution for businesses looking to streamline their accounting processes efficiently.

FreshBooks is a go-to accounting app known for its user-friendly interface and seamless invoicing capabilities. Small business owners can easily create and send professional invoices, track expenses, and manage projects all in one place. FreshBooks simplifies the invoicing process, making it ideal for entrepreneurs seeking a straightforward accounting solution.

Xero: Cloud-Based Convenience

Xero is a cloud-based accounting software offering small businesses convenient access to their financial data anytime, anywhere. With features like bank reconciliation, invoicing, and expense tracking, Xero ensures that users can stay on top of their finances with ease. Its synchronization across multiple devices makes it a reliable choice for entrepreneurs needing flexibility in managing their accounts.

![]() Best Accounting Apps for Freelancers and Solopreneurs

Best Accounting Apps for Freelancers and Solopreneurs

Wave: Cost-Effective Accounting

Wave is a popular choice for freelancers and solopreneurs looking for a cost-effective accounting solution. It offers a range of features without the hefty price tag, making it an attractive option for those starting or growing their business on a budget. With Wave, users can easily manage invoicing, track expenses, and generate financial reports without incurring additional costs. The platform’s user-friendly interface makes it simple for individuals without accounting backgrounds to navigate the software efficiently.

Zoho Books: Managing Business Finances on the Go

Zoho Books caters to freelancers and solopreneurs who need to manage their business finances on the go. This cloud-based accounting software allows users to access their financial data anytime, anywhere, making it convenient for individuals constantly on the move. Zoho Books offers features such as invoicing, expense tracking, and robust reporting functionalities to help freelancers and solopreneurs stay on top of their financial responsibilities. Its mobile app ensures that users can handle their accounting tasks seamlessly even while away from their desks.

![]() Security Measures in Accounting Apps

Security Measures in Accounting Apps

Data encryption is a fundamental security measure that best accounting apps employ to safeguard sensitive financial information. By encrypting data, apps convert it into a code that can only be accessed with the corresponding decryption key. This helps prevent unauthorized access and protects data integrity. In addition to encryption, reputable accounting apps often provide backup solutions to ensure data availability in case of system failures or data loss. Automated backups, both on local servers and secure cloud storage, help users restore critical financial data and maintain business continuity.

Data encryption is a fundamental security measure that best accounting apps employ to safeguard sensitive financial information. By encrypting data, apps convert it into a code that can only be accessed with the corresponding decryption key. This helps prevent unauthorized access and protects data integrity. In addition to encryption, reputable accounting apps often provide backup solutions to ensure data availability in case of system failures or data loss. Automated backups, both on local servers and secure cloud storage, help users restore critical financial data and maintain business continuity.

Adherence to financial regulations is crucial for accounting apps to ensure the integrity and legality of financial operations. These apps must comply with industry standards and regulations such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). By meeting these standards, accounting apps guarantee the accuracy and transparency of financial data, providing users with reliable information for decision-making and regulatory compliance. Trusted apps regularly undergo audits and certifications to demonstrate their commitment to compliance and data security. From small business owners to large enterprises, the diverse range of apps available cater to various needs, offering features like invoicing, expense tracking, and advanced financial management tools. For those looking to complement these capabilities with strategic marketing insights, a marketing management course can be a transformative addition.